Pursuit Bond

Training is not the only challenge to workforce development—there’s limited funding for an ever-increasing need. Our solution: an innovative financing model called Pursuit Bond that leverages impact investment and capital markets in addition to philanthropy. It is outcomes-based and is tied to Pursuit successfully helping create lasting jobs for the model to work.

Our long-term vision is to create a capital market for workforce development, unlocking critical funding for one of the most pressing socio-economic issues of our lifetime.

The Challenge

We’re grateful to our generous donors. At the same time, there’s not enough philanthropy to scale programs like ours to serve the millions of low-income New Yorkers who want to better themselves and their families.

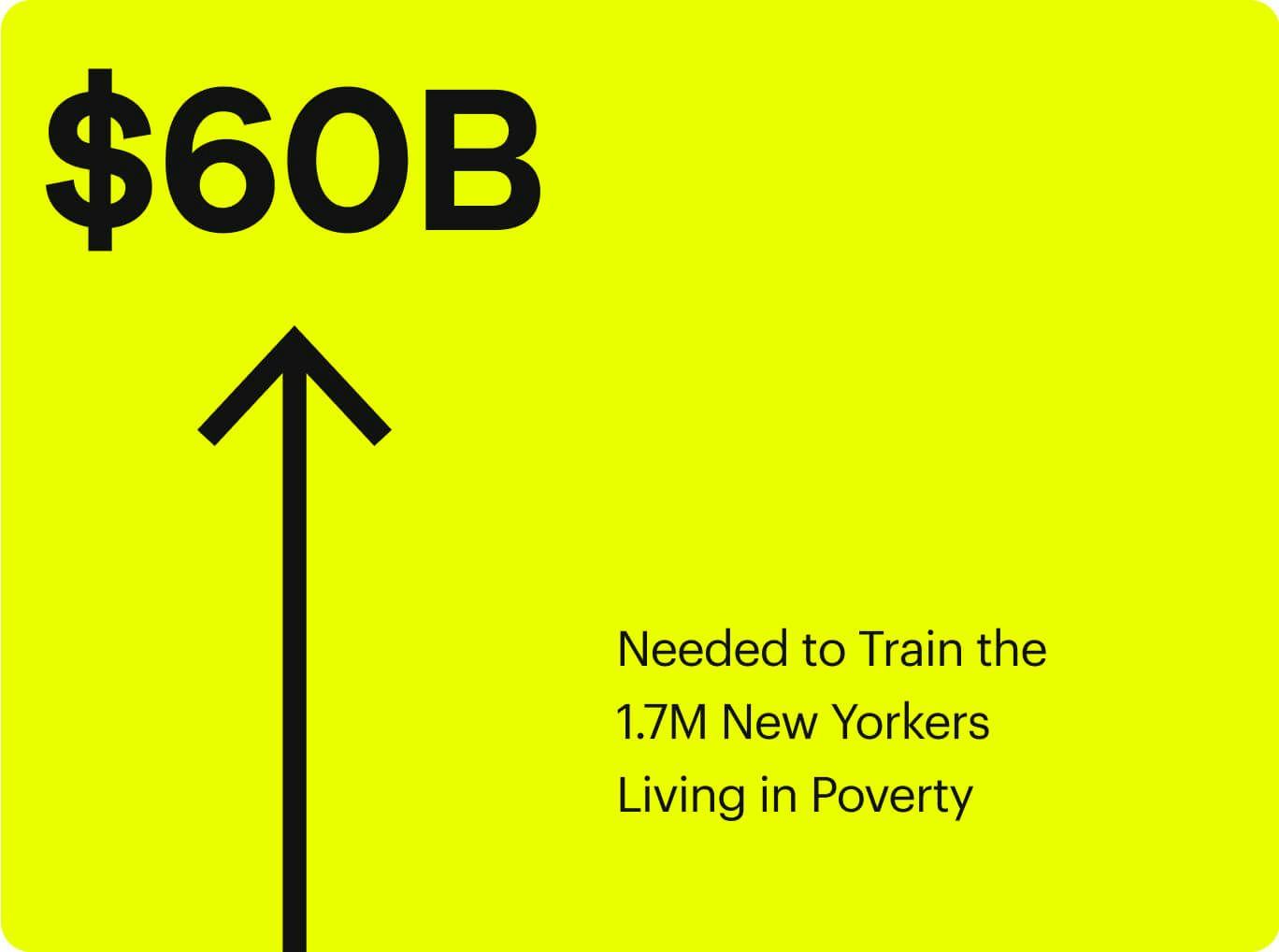

Even in one of the wealthiest and most generous cities in the country–New York City–there’s only $28 million in annual philanthropic funding for all adult job training.

That’s only enough to train 2,000 people—less than 1 percent of the 1.7 million New Yorkers who are currently unemployed and stuck in low-wage jobs. The scale of the need massively outweighs the supply of funding.

The Solution

With Pursuit Bond, we’re able to secure funding from impact investors to create high-quality programs and deliver those programs to many more people than would be possible with grants and donations alone.

The funding model comes full circle with our Fellows. With Pursuit Bond, our Fellows don’t pay anything upfront. Instead, they pay a percentage of their gross earnings for a set amount of time when they get high-paying jobs. If they don’t have a job, or if their salary falls below a certain level, they pay nothing. Our success is their success.

Why Pursuit Bond Matters

Impact

Pursuit Bond enables us to provide high-quality programs that help Fellows go from $18k to over $90k on average.

Skin in the Game

Pursuit Bond makes us accountable for Fellow outcomes. If they don’t get high-paying jobs, the model does not work. In other words: we’re only successful if they’re successful. That's why we give it our all to our Fellows to help them build their careers.

Long-Term Commitment

We are invested in the long-term success of our Fellows. We commit to providing career-building services that help our Fellows keep their jobs, get raises and promotions, and find their next great opportunity. This is important not only because it helps our Fellows better their lives and careers, but also because it enables us to invest more in our programs to better serve our Fellows.

Our long-term goal is to create a sustainable organization and program. In addition to unlocking capital markets, Pursuit Bond can become a renewable source of funding. Once our social impact investors get repaid for their investment, they can re-invest it back into Pursuit. By putting those funds back into action, we can create an even better program and serve even more people. This aligns our funding model with our mission: to create economic transformation.